Until last week, a correction seemed far away.

But when I woke up, the market had plummeted.

I shouldn't be doing this, but the corner of my mouth was turning up.

Is the reconciliation finally starting to happen?

TQQQ's yields have fallen due to the market's sharp drop today after a good run until Thursday.

TQQQ is down over 8% from the previous week.

It's slow to rise from a high point, but it's relentless when it falls.

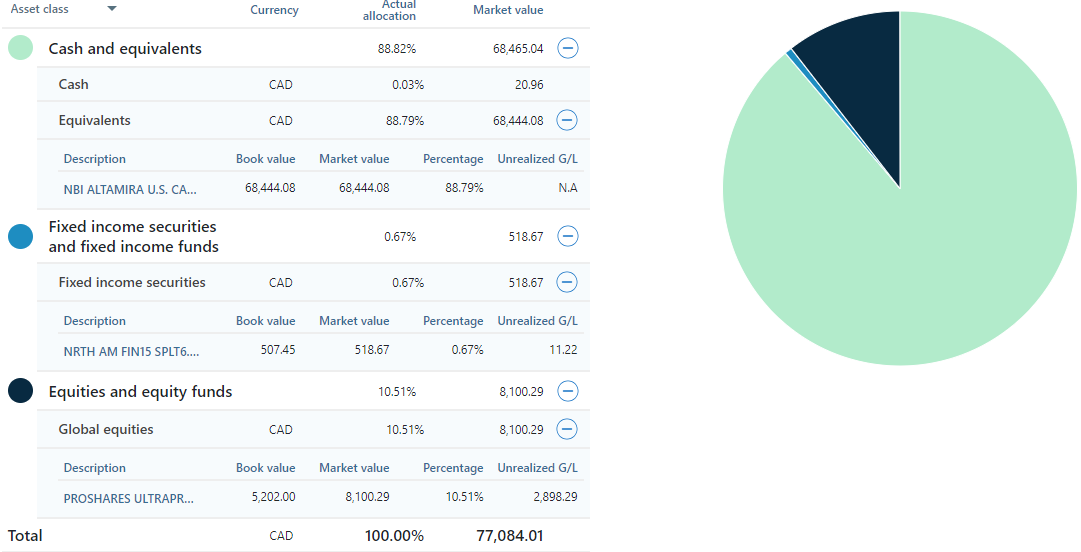

NBC101 finally crossed the $50,000 mark as all of last week's bets were bought.

I'm proud. And then QQQY's dividend came in, so I had a little more cash.

Once I got everything sorted out, I love the simplicity of the account.

We expected to see a significant drop in assets due to the market decline.

Since you currently have 100 shares, you defended the $700 drop.

The cash ratio is currently over 89%.

Equities are only 10.5 per cent.

I looked at one of the sells and it looks good.

After all, when others say it's going to go up, it's right to do the opposite.

To survive in the market, you should aim for moderate profits, not maximum profits.

Dividends came in and the investment ratio went down a bit more.

POOL has a value of $51,137.

If a correction were to occur, it would be worth over $50 million.

You have to be brave when others are afraid, so you can take the profits you want.

We will also commit more than 70% of our cash if the opportunity arises.

Nasdaq 100 hits this week.

Looking at the heatmap, the semiconductor sector still looks strong.

However, most of the semiconductor stocks are down sharply today.

Nvidia in particular is down 5.55% today and is up 9% for the week.

I think it really shows that the semiconductor sector is hot.

And Apple and Tesla's declines stand out.

I wonder when it will bottom out and start moving up.

The F&G index finally came down from the extreme greed zone.

For over a month, I was in an extreme greed zone.

However, today's sharp drop in semiconductor stocks has taken us out of the extreme greed zone.

We'll know when next week's market opens if it's just a blip this week or the start of a correction.

Today's market decline also brought the Nasdaq 100 PER down slightly.

The forward PER has come down more than the current PER, reflecting this week's performance.

I still think anything over 30 is still expensive.

If you look at the chart of QQQ, it broke out to the top last week, but failed to break through this week.

And a collection that settles at the support line below it.

However, that long bearish candlestick is clouding the outlook for next week.

The Nasdaq 100, which broke out of its range last week, has started to make a range again this week.

And today, it reversed all of this week's gains to the downside.

The RSI continues to cascade down and F&G has also broken out of the extreme greed zone.

We'll see next week whether it goes into a correction or bounces off the current support level.

This is a chart of Nvidia, the boss of the semiconductor sector.

It hit historic highs and then plummeted.

I'm looking at this chart and wondering if it signals the beginning of a correction.

I could be wrong, of course, but it's definitely an unusual candle.

The chart above is a monthly chart of the Nasdaq 100.

I plotted the highs and lows from 2009 to the present.

The only time the candle broke that pink line was during the coronavirus.

In hindsight, there's a reason I was able to break through and climb like that.

That's because of the Fed's money printing and zero interest rates.

The reason why we are not breaking the top is because the situation is the opposite of what it was during the coronavirus.

High interest rates and the Fed not printing money.

If the economy is good, companies are performing well, new technologies are coming out, but not in the context of low interest rates and quantitative easing,

It seems that the market can overheat but not bubble.

The chart above shows a Fibonacci line plotted on a TQQQ chart.

It's not 100% perfect, it doesn't catch the lows, but you can still see that it's going down.

Therefore, my next buy price is expected to be around $43.

Of course, you could be wrong and you could be right. But it's better than buying without a plan,

I'm sure you'll get better results if you have your own expected scenarios.

This is a chart of SOXL.

If anyone is planning to buy SOXL, this would be a good reference.

Not everyone can hit the highs and lows.

However, if you buy and sell below that, you can get good results.

My buy condition is that the price is around 0.618 of the Fibonacci sequence and the F&G is below 25,

We will buy aggressively when the RSI drops below 30.

And if the RSI diverges, I think it's a better buying opportunity.

Temu:Click the link to get CA$100 Coupon Bundle !

Temu | Explore the Latest Clothing, Beauty, Home, Jewelry & More.

www.temu.com

'Invest Diary' 카테고리의 다른 글

| March 20, 2024 TQQQ shorted outright (1) | 2024.03.21 |

|---|---|

| 15 March 2024 TFSA - Down for 2 weeks (0) | 2024.03.17 |

| FEB 23 2024 TFSA ACCOUNT REVIEW (0) | 2024.02.25 |

| FEB 16 2024 TFSA ACCOUNT REVIEW (0) | 2024.02.18 |

| FEB 9 2024 TFSA Account (0) | 2024.02.10 |

댓글