The Nasdaq 100 is down big today.

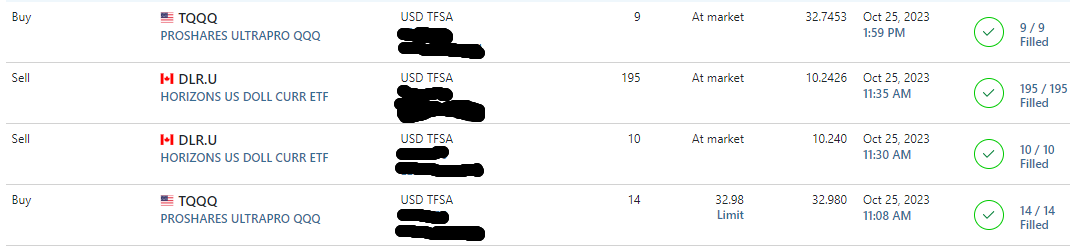

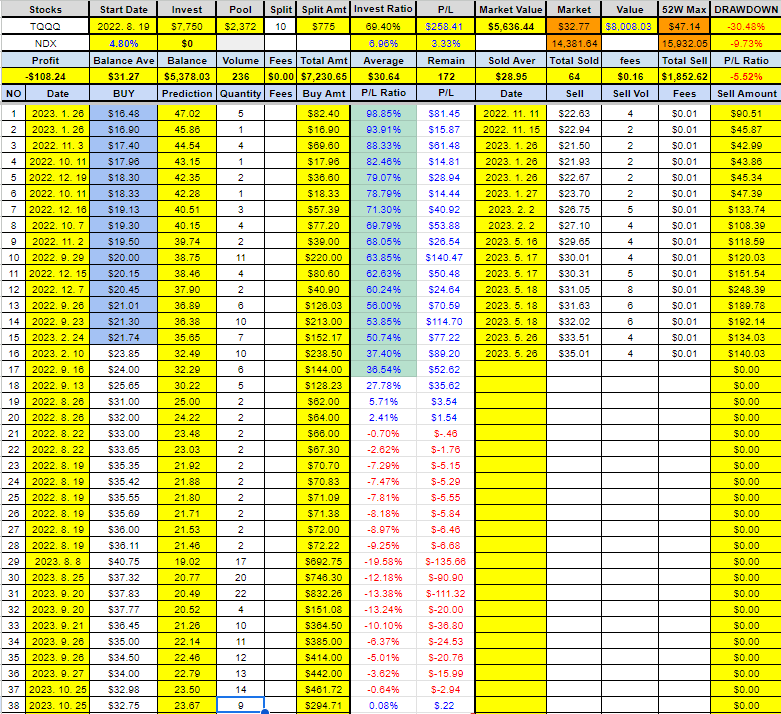

Then my long bet came through and I bought another 23 shares for a total of 23 shares.

The first purchase price was 13 shares at 32.98 and 9 shares at 32.745.

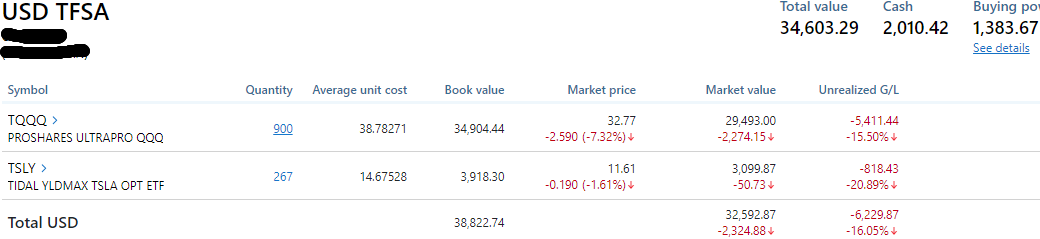

Today's purchase brings the total number of shares of TQQQ to 900.

DLR.U sold out at the market price.

It was pretty much a wash when I compared DLR.U's dividends to its losses, so I sold it all at the market.

Between the losses and dividends, I sold for about $2.50.

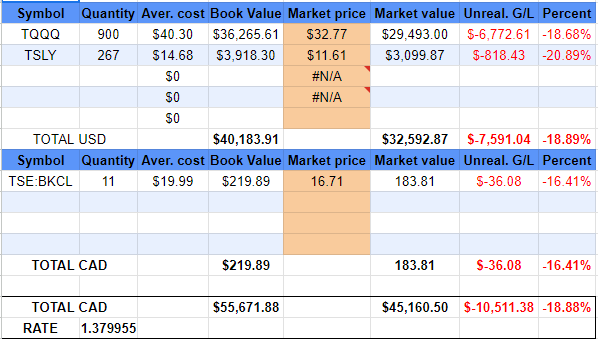

The current quantity of TQQQ is 900 shares.

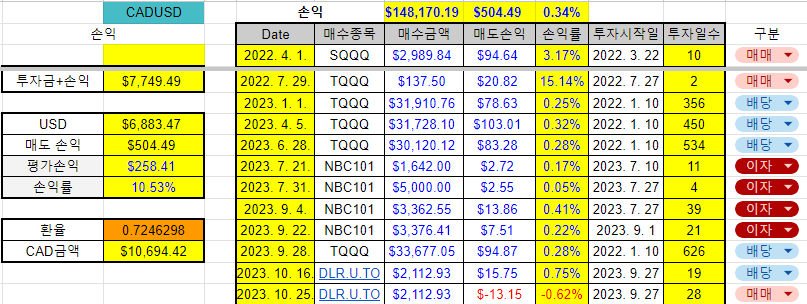

And I have $1000 long on NBC101.

Today's buy rating is down slightly from 38.93 to 38.78.

TSLY is still above -20%.

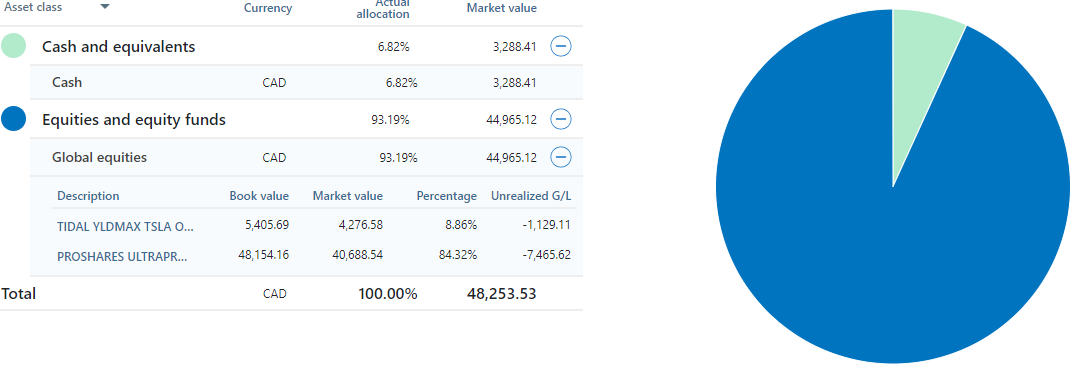

With today's purchase, the cash ratio fell from 8.7% to 6.82%.

Total assets are down again by about $1300.

I'll be buying again tomorrow if the opportunity presents itself.

Looking at the current sheet, we have about $2372 in cash left.

The funded ratio is currently 69.4%.

You're down to 3 left in 10 installments.

I don't know if there will be more buying opportunities in the future.

Still, I want to maximize my buying opportunities.

Holdings as of today.

As DRLs disappeared, asset prices decreased.

Losses increased by another 4%.

This is a chart of the current TQQQ.

It is currently in a downtrend, making lower highs and lower lows.

It looks like there is a good chance that October will end on a down note as well.

However, none of the risks experts predict have occurred in the U.S. yet.

It's all external factors. Ukraine, Israeli oil prices, etc. are all external factors.

U.S. oil companies benefit when oil prices rise.

The same is true when grain prices rise.

War-induced inflation is temporary.

We showed that with the Ukraine-Russia war.

Unlike South Korea, the United States is the only country fully self-sufficient in oil and grain.

You can profit from any commodity spike.

So let's set aside our worries about the US and use the dip as a good buying opportunity.

The Nasdaq 100 is now down about 10% from its high.

Even though the news and broadcasts said so and said it was dangerous.

It is currently down about 10% from its high.

Are they scaring us into selling?

Or are they selling out?

It's worth thinking about.

'Invest Diary' 카테고리의 다른 글

| FEB 16 2024 TFSA ACCOUNT REVIEW (0) | 2024.02.18 |

|---|---|

| FEB 9 2024 TFSA Account (0) | 2024.02.10 |

| OCT 20 2023 TFSA ACCOUNT AND BUYING TSLY SHARES (0) | 2023.10.22 |

| Oct 6 2023 TFSA Account (0) | 2023.10.10 |

| TSLY October Dividend Information (0) | 2023.10.06 |

댓글