This is a TFSA account review for the last week of September.

TQQQ is 877 weeks, up 36 weeks from the previous week.

Losses are up and down from the previous week.

TSLY is up about 2.5% week-over-week.

Then I bought DLR and subscribed for JOURNAL, which was transferred to my USD account.

I'm thinking of selling next week to see what happens.

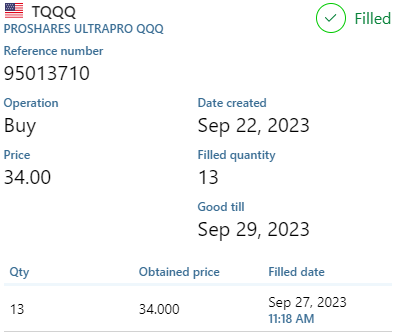

On September 26 and 27, I bought more TQQQ.

A total of 36 additional shares were purchased.

And on September 28, the dividend came in.

The total dividend is $111.61 and the tax is $16.74.

I got enough money to buy about TQQQ for 3 more shares.

It's not a lot of money, but it still feels good to get it every quarter.

This week, there are some changes in assets due to additional purchases and dividends.

The cash ratio decreased from 11.17% to 8%.

The stock ratio is finally above 90%.

Total assets are up about $600 from last week.

I'm looking forward to buying more next week.

The Swing sheet is unchanged from last week.

The loss was also about $10.

The POOL is now $1000 lower due to the additional purchases.

The total investment ratio was over 60%.

And when the total assets were over $7000, I increased the split from 9 to 10 again.

There was little movement in the indices this week.

The additional buying pushed the price back up by about a dollar.

The additional purchases lowered the yield, but the profit was $40 higher than the previous week.

TSLY's total return went from -7.41% to -4.91%.

The quantity remained the same and the loss was about $80 less than the previous week.

There will probably be a dividend announcement next week.

However, this month's correction is so severe that I think it will be lower than last.

With the increase in share price, TSLY's payout ratio is 45.71%, down from the previous week.

My odds remain the same.

TSLY's ex-dividend date is October 5th.

As shown in the table above, we expect the October dividend to be about 10 cents lower than delivered.

I'll be writing more about it after the announcement.

This week, the Nasdaq 100 has a PER of 29.55.

Down 0.2 from last week.

The FORWARD 12M PER is 26.15, down from last week.

Q3 earnings reports will now begin in October.

This makes me wonder how much more the PER will change.

On Friday, an issue popped up.

The US shutdown issue.

I don't know when this issue will be resolved, but it looks like a good buying opportunity.

Hopefully, we'll have a buyer's market next week.

'Invest Diary' 카테고리의 다른 글

| Oct 6 2023 TFSA Account (0) | 2023.10.10 |

|---|---|

| TSLY October Dividend Information (0) | 2023.10.06 |

| NASDAQ TOP 10 in September (0) | 2023.10.01 |

| 9/22/2023 TFSA account and purchase of TQQQ and TSLY (0) | 2023.09.25 |

| Buy TQQQ on September 20, 2023 (0) | 2023.09.21 |

댓글