Tweaking is a bitch.

The Nasdaq ended the week on a positive note.

I'm exiting hard and the market is going crazy.

The market was quiet until Wednesday, and then it went up on Thursday, and then it went up today.

As a result, TQQQ is up about 9% from the previous week.

I sold 250 shares of TQQQ and all of TSLY and QQQY because the market was up today.

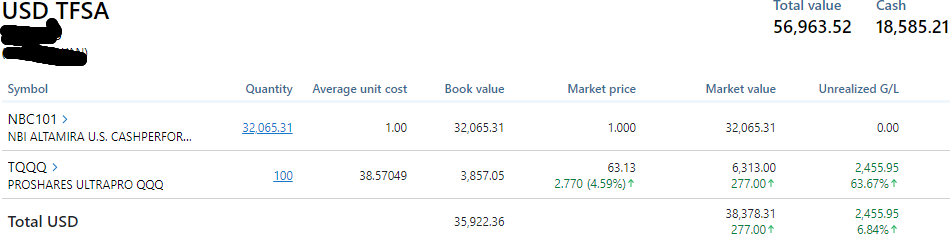

So the account is simple again.

TQQQ has 100 shares left and over $50,000 in cash.

It feels good to just look at my account.

With today's sell-off, those are now 89:11 in cash and stocks.

On account, of course.

Total assets rose to $77,762.

I'm about $23,000 away from the next $100,000.

Today's sell-off lowered the percentage invested to 7.16% and increased the invested funds to $54,961.

POOL currently has $51,029 left.

I had a total buy amount of $38,892 and a total sell amount of $47,975.

This means that the remaining quantity is currently free money.

With the current amount in the POOL, you have 9+@ to buy.

I think there will be one more buying opportunity in the future, but I don't know when.

I've got plenty of cash in the bank, though, so I'll take my time.

This week's heatmap of the Nasdaq 100.

Semiconductors led the awards gains this week.

Tesla has also bottomed out and is on the rise.

Apple and Google dropped a bit this week.

F&G is still in the extreme greed zone.

This is week 4.

So I sold aggressively yesterday and today.

It feels good to sell.

I don't think I've ever seen an extreme greed zone in week 4.

The PER is lower than last week.

I think it's lower because other companies like Nvidia are doing well.

I think 33 is still high though.

I think we're at a point where it wouldn't be surprising if the market goes down tomorrow.

Looking at the QQQ chart, today's candle seems to be trapped within two purple lines.

And it's getting more and more wedge-shaped.

Today's long white candlestick broke the four-week range.

Charts can be interpreted in many ways,

I wonder if it means that no one can predict the market right now.

If you look at the chart above, you can see that today's candle broke through the range.

And if you look at the RSI, the stock price is going up, but the strength of the RSI is getting lower and lower.

Interpreted from the chart above, we can expect a drop soon.

But I don't know, because none of my predictions are working these days.

The chart above is a weekly chart.

You can see that it has risen steeply since October last year without any correction.

And you can see that the RSI has low strength compared to the current stock price.

The indicators I see are pointing down, but I'm not convinced.

When in doubt, cash is best.

If it goes up, the remaining balance will give you more profit, and if it goes down, you can pick it up again.

I only have 100 shares, so I'm going to take it easy and watch the market.

Temu:Click the link to get CA$100 Coupon Bundle !

Temu | Explore the Latest Clothing, Beauty, Home, Jewelry & More.

www.temu.com

'주식투자 > TFSA 계좌' 카테고리의 다른 글

| 2024년 3월 8일 TFSA 계좌-조정의 시작인가? (0) | 2024.03.11 |

|---|---|

| 2024년 3월 1일 TFSA 계좌-기다리는 조정은 오지않는다. (0) | 2024.03.03 |

| 2024년 2월 23일 TFSA계좌 - 인디언 기우제 (0) | 2024.02.26 |

| 2024년 2월 16일 TFSA계좌 - 조정인가? (0) | 2024.02.19 |

| 2024년 2월 9일 TFSA 계좌-시장이 미쳤다. (0) | 2024.02.11 |

댓글